本文

英語による税金の説明

Daily Life And Taxes (PDF:1024KB)

What is a tax?

What would happen to our world if it were not for taxes? We would be unable to receive any public services: firefighting and rescue efforts by fire departments, crime control by police stations, education, waste disposal, roads, parks, water supply and sewerage systems, medical treatment at hospitals. These various public services are provided by our tax money.

When are taxes due?

Different taxes have different due dates. You are to pay your taxes before the deadline.

What will happen if I don’t pay my taxes?

The rules are that you pay your taxes in lump sum within the due date. If you cannot pay in lump sum, you can pay installments plus delinquent charge. For details, please consult your local Gyoseikenzeijimusho or the Prefectural Administrative Affairs and Tax Office. If you don’t pay your taxes by any means, your assets such as savings, salary, or automobiles will be seized.

Tax consultation service at tax offices

Automobile tax

Individual Enterprise Tax or Kojinno Jigyo Zei【Abridged Version】

Real Estate Acquisition Tax

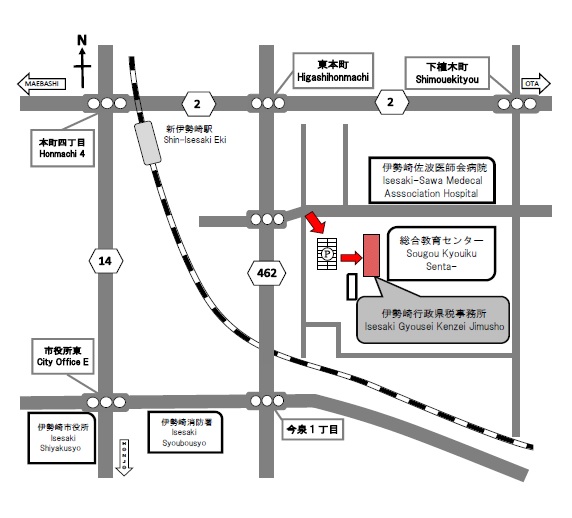

〒372-0031

Gunma-ken Isesaki-shi Imaizumi-cho 1-236

Gunma-ken Isesaki Gyosei Kenzei Jimusho

Tel:0270-24-4350

Fax:0270-24-1628